Home Energy Storage Prices Set to Surge as Lithium Carbonate Costs Skyrocket – Act Now Before It’s Too Late

Lithium Alert: Prices Predicted to Surge 35% – Don’t Miss Out!

In a dramatic shift that could soon hit consumers’ wallets, the price of home energy storage batteries is poised to rise sharply due to a sustained surge in lithium carbonate prices. The warning comes after leading global investment bank J.P. Morgan issued an extremely bullish report on the lithium market, drastically raising its price forecasts and upgrading its outlook for all pure-play lithium miners.

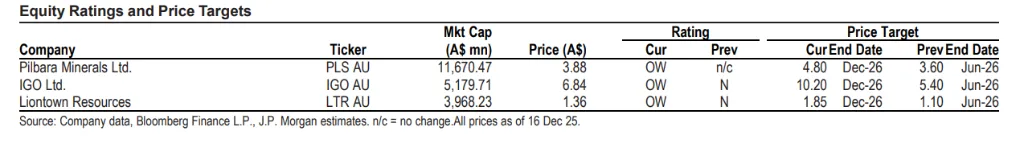

On December 17, 2025, analysts led by Lyndon Fagan at J.P. Morgan made a striking prediction: they lifted their price target for lithium carbonate to $18,000 per tonne for the fourth quarter of 2026. This is a substantial increase from the current spot price of approximately $13,500 per tonne. Similarly, the target for spodumene concentrate, a key raw material, was doubled to $2,000 per tonne.

This revision is not just a number on a page; it has immediate real-world consequences. J.P. Morgan responded by upgrading its rating for all covered pure-play lithium mining companies to “Overweight,” signaling strong confidence in their stock performance driven by soaring commodity prices.

The Core Driver: Exploding Demand Outpaces Supply

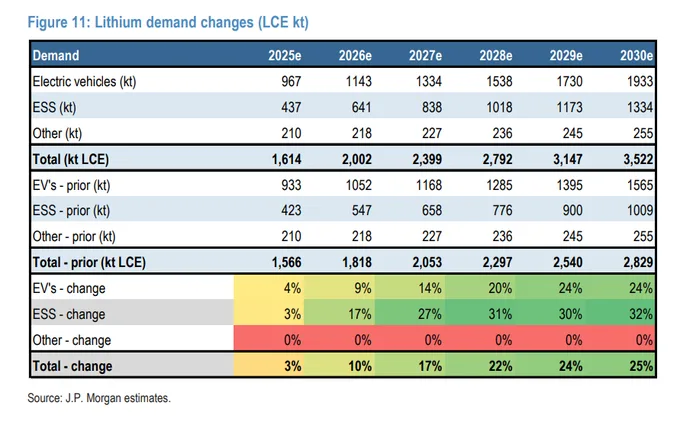

The bank’s analysts pinpoint a simple yet powerful trend: global lithium supply is growing, but it is failing to keep pace with “explosive” demand expansion. Two major factors are creating a widening supply gap:

- Energy Storage Systems (ESS): Massive growth in grid-scale and commercial battery storage projects is consuming vast quantities of lithium.

- Chinese Commercial Vehicles: A significant upward revision in demand from electric trucks and buses in China is further straining the market.

This imbalance is expected to push the market into what J.P. Morgan calls a “prolonged incentive pricing environment,” meaning prices must remain high to justify and attract new mining investments—a process that takes years.

What This Means for Your Home Battery

Lithium carbonate is a fundamental component of the lithium-ion batteries that power home energy storage systems, such as the Tesla Powerwall, LG Chem RESU, and countless other brands. Raw material costs typically account for a significant portion of the final product’s price.

As lithium prices climb, battery manufacturers will inevitably face higher production costs. To maintain profitability, these increased costs will be passed down the supply chain to distributors and, ultimately, to end consumers. A significant price increase for home battery packs is now a near certainty in the coming months.

The Time to Act is Now: Don’t Stay on the Sidelines

For homeowners considering investing in energy independence, backup power, or maximizing solar energy usage, this market shift creates a clear imperative: the most cost-effective time to purchase a home energy storage system may be right now.

- Lock in Current Quotes: Prices offered today are based on current material costs. Waiting could mean paying a premium of hundreds or even thousands of dollars for the same system.

- Secure Your Investment: Installing a battery system now protects you against future energy price volatility and provides immediate value, while also securing a price point before the impending hike.

- Beat the Rush: As news of rising battery prices spreads, demand may surge from buyers hoping to beat the increase, potentially leading to longer wait times for installation.

Conclusion

The message from the financial markets is clear: structural forces are driving lithium prices much higher for the foreseeable future. This fundamental shift will directly impact the cost of the technology that stores clean energy in our homes. If you have been contemplating a home battery system, this is a decisive moment. Consulting with an installer and securing a purchase agreement before the full effect of lithium price increases filters through to retail could result in substantial savings. Don’t wait—the cost of waiting and seeing is about to go up.