China’s Grid-Scale BESS: 6,000 Cycles at 50°C! Unbeatable Heat Resilience

China’s Grid-Scale BESS Solutions for Extreme Climates & Vision 2030

China dominates global BESS manufacturing—with industry leaders like Sungrow (16% global market share) and Huawei spearheading innovation in high-capacity, high-reliability energy storage for grid and off-grid applications. For Saudi projects demanding extreme heat resilience and rapid ROI, Chinese suppliers deliver unmatched technical and commercial value.

🔥 1. Unmatched Technical Edge: Heat Resilience & Cycle Life

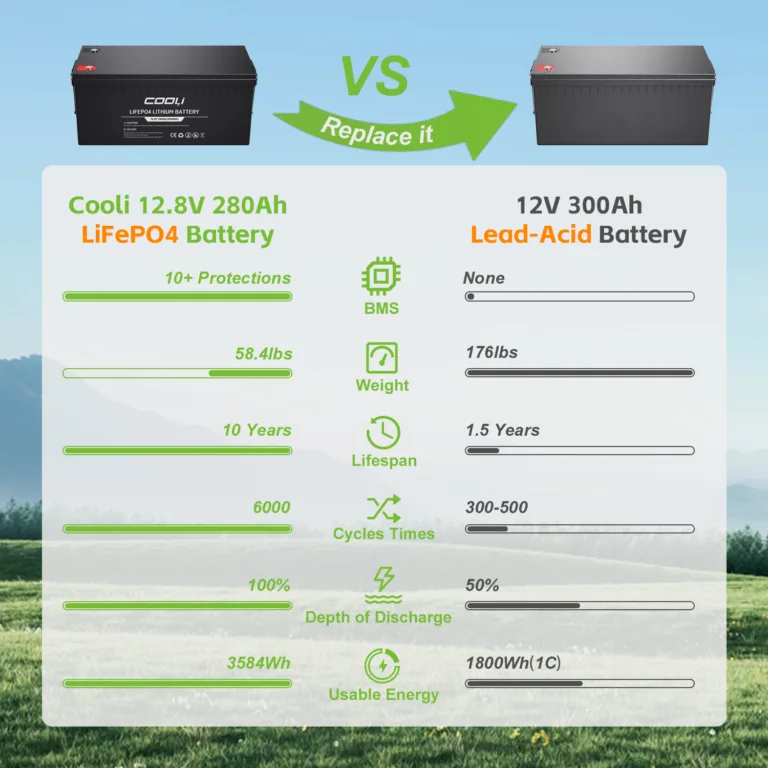

- LFP Chemistry Mastery: Chinese BESS containers integrate LiFePO₄ batteries achieving 6,000+ cycles at 50°C ambient temperatures—critical for Saudi Arabia’s desert climate. Greensun’s 20-year warranty containers guarantee stability even in harsh environments.

- Liquid Cooling Revolution: Precision thermal management (e.g., Sineng’s PCS, CCRC’s 5MWh container) maintains cell temperature differentials below 4°C, slashing degradation by 30% and boosting lifespan beyond 10 years.

- Multi-Layer Safety: New Energy Zhichu’s 4-level fire protection (PACK-level detection + full-flooding suppression) and cell-level health monitoring prevent thermal runaway—compliance with UL 9540A and NFPA 855 standards.

⚡ 2. Saudi-Specific Case Studies: Off-Grid & Grid-Scale Triumphs

- Red Sea Mega Project (1.3GWh): Huawei’s off-grid BESS powers Saudi’s luxury resort coastline using Grid-Forming algorithms for stable islanded operation—enabling <10¢/kWh levelized electricity cost and displacing diesel.

- Madinah Microgrid: Sineng’s hybrid inverters + 2H containers (4MWh) synchronize solar, storage, and gensets—achieving 99.3% grid autonomy for critical infrastructure.

- Vision 2030 Alignment: Advanced Energy’s containerized systems support Saudi’s 50% renewable target by 2030—turnkey solutions cut commercial/industrial power costs by 25–40% via peak shaving and demand response.

🏭 3. Industrial Containerized Systems: Plug-and-Play ROI

- Space-Smart Density: CCRC’s 20ft 5MWh+ containers occupy 30% less area vs. previous-gen units—ideal for land-constrained Saudi sites.

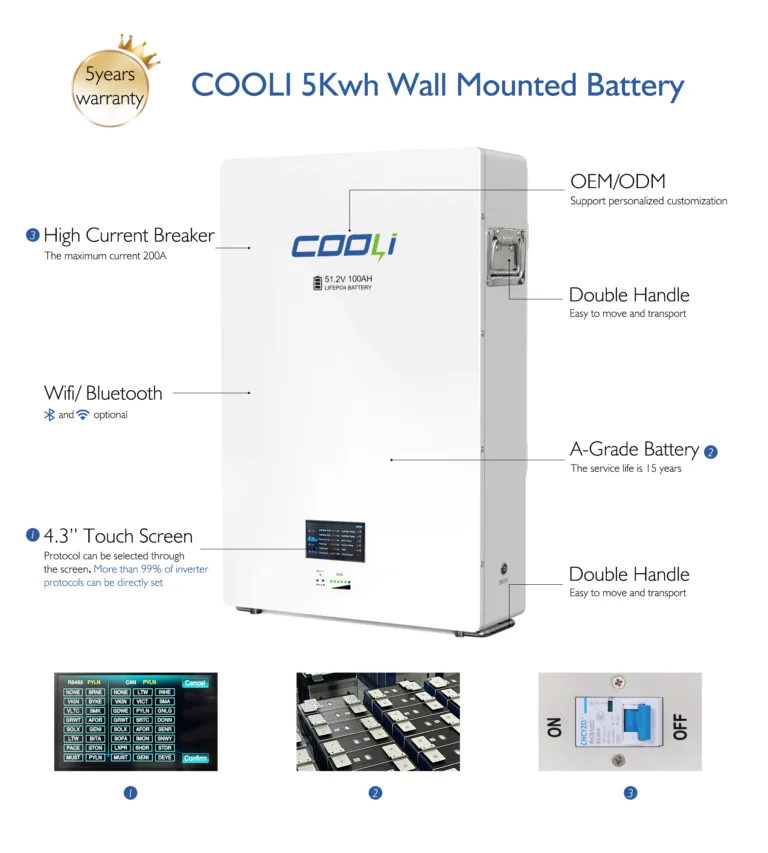

- “All-in-One” Integration: Greensun’s cabinets merge PCS (50–100kW), BMS, and HVAC into one IP65-rated unit—reducing deployment time by 50% and O&M costs by 20%.

- Peak Shaving Automation: Chongqing BOE’s 15MWh project leverages AI-driven “valley charge/peak discharge” to slash electricity bills—ROI achieved in <3 years.

✅ 4. Why Chinese BESS Suppliers Lead in Saudi Markets

- Cost-Disruptive Scale: Sungrow’s vertical integration (battery + PCS + EMS) enables $0.28/Wh system pricing at 1MWh+ volumes—undercutting U.S./EU rivals by 25%.

- Transformer Supply Chain: Strategic partnerships bypass global transformer shortages—Sineng guarantees 12-month project delivery (vs. industry average 18 months).

- Vision 2030-Ready: Dedicated technical teams in Riyadh/Dammam provide localized commissioning and 24/7 support—ensuring compliance with SASO and SEC regulations.

☀️ Saudi Vision 2030 demands scalable, heat-tolerant energy storage—and China’s BESS manufacturers deliver with bankable tech and desert-proven economics.

Optimize your Saudi energy projects: Request a custom proposal for 4–6MWh containers with LFP batteries, liquid cooling, and Saudi grid compliance—engineered for 50°C summers and 6,000-cycle lifespans. Contact Chinese Supplier for project casebooks + Madinah microgrid specs.