Global Lithium Battery Leaders: Country Rankings & Market Trends 2030

Global Lithium Battery Leaders: Country Rankings and Market Trends Shaping the Lithium-Ion Landscape

Lithium-ion batteries have become the lifeblood of the clean energy transition, powering everything from smartphones to electric vehicles (EVs). As nations scramble to secure their foothold in this trillion-dollar market, a clear hierarchy of battery superpowers has emerged—with China holding a commanding lead, and the U.S. and Europe racing to close the gap.

🥇 The 2030 Leaderboard: Capacity by Country

Based on projections from Benchmark Mineral Intelligence, here’s how the top lithium-ion battery-producing nations will stack up by 2030:

| Country | 2030 Capacity (GWh) | Top Producers |

|---|---|---|

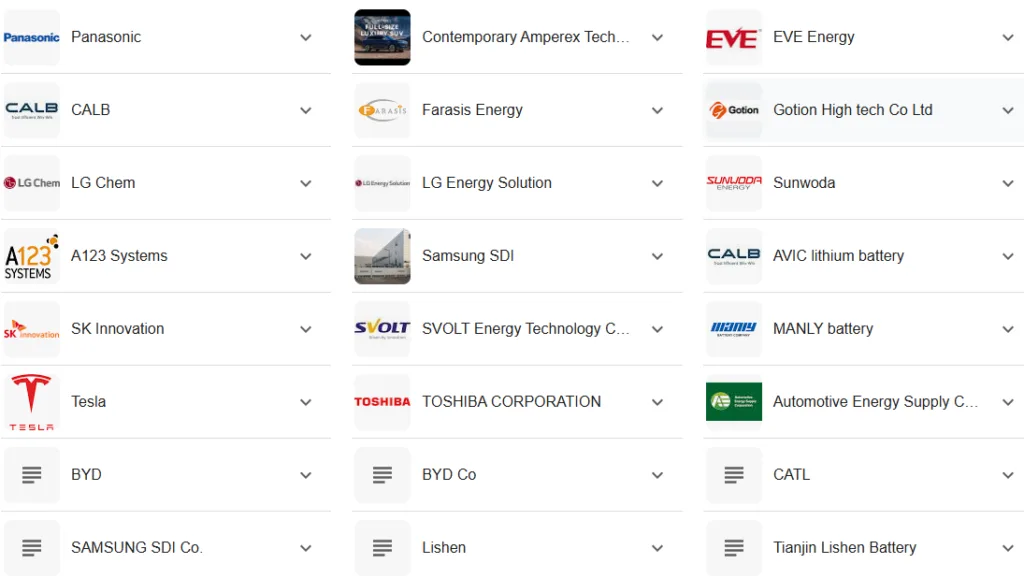

| 🇨🇳 China | 6,268 | CATL, BYD, CALB |

| 🇺🇸 U.S. | 1,261 | Tesla, LGES, SK On |

| 🇩🇪 Germany | 262 | Tesla, Northvolt, Volkswagen |

| 🇭🇺 Hungary | 210 | CATL, SK On, Samsung SDI |

| 🇨🇦 Canada | 204 | Northvolt, LGES, Volkswagen |

| 🇫🇷 France | 162 | Verkor, Prologium, ACC |

China’s dominance is staggering: It alone will supply nearly 70% of global capacity—more than all other nations combined. CATL, its top producer, will output more than Canada, France, Hungary, Germany, and the UK’s total production . The U.S. will trail distantly in second place (~1,260 GWh), while Europe’s leader, Germany, will anchor the continent’s supply chain with Tesla’s Giga Berlin as its cornerstone .

📈 Market Trends Reshaping the Ecosystem

1. China’s Vertical Integration vs. Western Catch-Up

China’s supremacy stems from its control over the entire EV supply chain—from mining critical minerals (e.g., Tianqi Lithium owns 51% of global lithium reserves) to battery assembly and EV manufacturing . Six of the world’s top 10 battery manufacturers are Chinese , and they’ve locked down cobalt mines in the Democratic Republic of Congo and lithium assets in Australia and South America.

Yet China’s share is slowly eroding:

- 2020: 75% of global capacity

- 2030 (projected): 66%

This decline reflects aggressive investments in the U.S. and Europe, driven by policies like the U.S. National Lithium Battery Blueprint ($7B for supply chain security) and Europe’s push to localize 25% of battery production by 2025.

2. Exploding Demand & Material Constraints

- Global EV battery output will surge sixfold to 2,585 GWh by 2030 (ABI Research).

- Critical mineral demand will skyrocket: lithium by 5.3x, cobalt by 3.2x (2022–2030).

High lithium prices are accelerating alternatives like sodium-ion batteries for energy storage and low-speed EVs, while cobalt reduction efforts will slash average battery cobalt content by 44% by 2030.

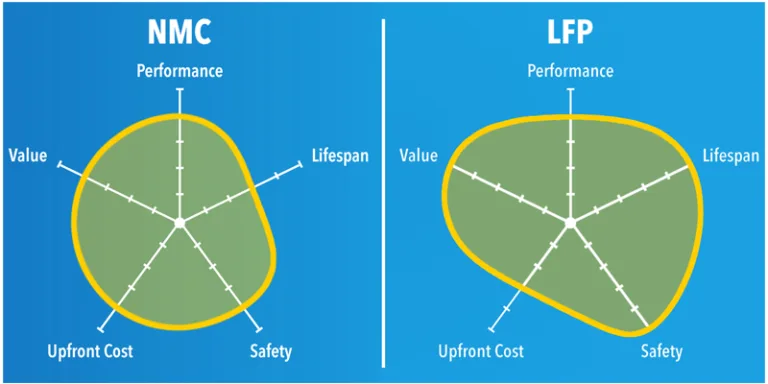

3. Tech Shifts: LFP Dominance & Solid-State Delays

- LFP (lithium iron phosphate) batteries now outsell NMC (nickel manganese cobalt) variants in China due to lower costs and safety advantages.

- Solid-state batteries, despite hype, face ≥10-year commercialization delays due to manufacturing complexity. Evolutionary improvements to existing lithium-ion tech (e.g., silicon anodes, cell-to-pack designs) will drive near-term gains.

🌍 Geopolitical Tensions & Innovation Frontiers

Supply chain sovereignty is now a strategic imperative:

- Europe aims to raise its global capacity share from 7% to 25% by 2030 via gigafactories like Northvolt in Sweden and ACC in France.

- The U.S. is funneling $17B toward EV manufacturing loans and mineral recycling to bypass Chinese refining.

Meanwhile, battery architecture—not just chemistry—is emerging as a game-changer. Transitioning from 2D to 3D electrode structures could boost energy density and solve power mismatch issues.

💡 The Bottom Line

“While China’s grip on battery production remains formidable, the West’s $100B+ investments signal a rebalancing. The next battleground isn’t just gigafactories—it’s ethical supply chains, cobalt-free chemistries, and manufacturing AI.”

As the race heats up, expect trade wars over minerals, tighter ESG standards, and a new wave of battery recycling startups. One thing is certain: batteries will define the geopolitics of decarbonization this decade.

Ps:

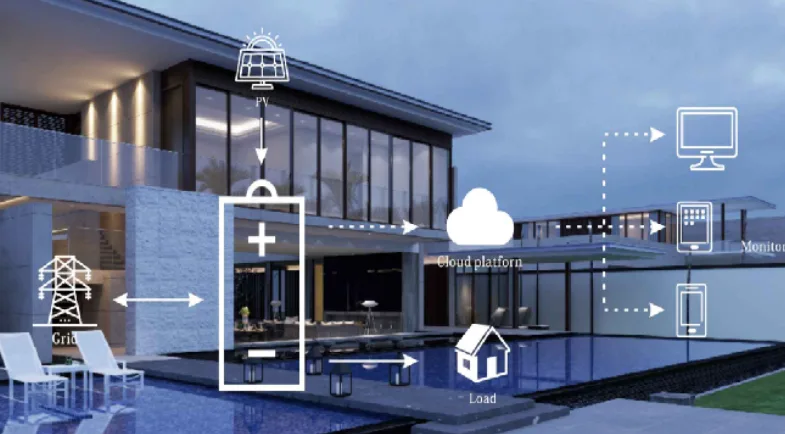

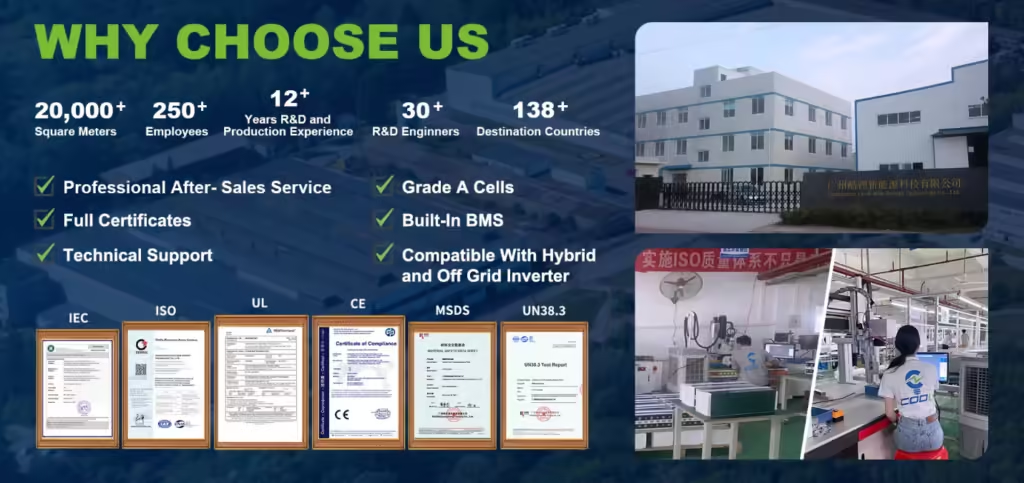

Coolithium: Your Trusted Partner for Premium Small-to-Medium ESS

Amidst soaring demand, Coolithium leverages 15 years of industry expertise to deliver high-quality, cost-optimized energy storage batteries. As a preferred partner for wholesale clients, we specialize in small-to-medium ESS solutions where low price, rigorous quality control, and unbeatable value converge. For businesses prioritizing reliability without compromise, Coolithium offers your competitive edge.

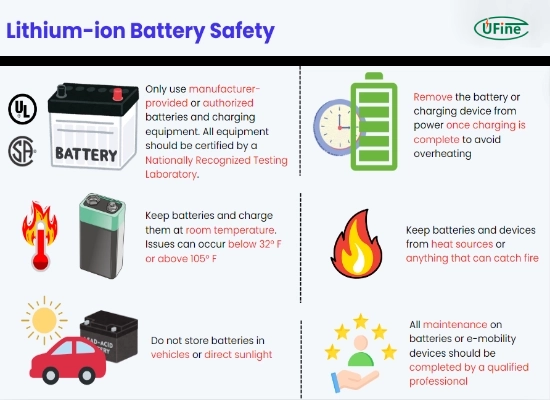

5kWh LiFePO4 Battery in Vietnam 10kWh Energy Storage Solutions for Yemen 15kWh LiFePO4 Solar Storage 15kWh Solar Battery 24V vs 48V Lithium Battery 48V Lithium Batteries 51.2V 200Ah 10kWh Battery 51.2V 200Ah LiFePO4 Batteries Wholesale 150kW Solar System 300Ah 51.2V Floor Standing Battery Battery IP Ratings battery manufacturer in China Best LiFePO4 Batteries Engineered for Middle East Desert Best Lithium Battery in Pakistan Bulk Buy Home ESS China DDP Wholesale China Sourcing Tips China’s Top Battery Manufacturer Custom Household Batteries Direct Factory Custom Lithium Batteries Depth of Discharge (DoD) energy storage battery Grade A Battery home energy storage Lead-Acid to Lithium LiFePO4 batteries LiFePO4 Batteries in Australia LiFePO4 Batteries in the Philippines LifePo4 battery LiFePO4 Battery Manufacturers LifePO4 Battery Technology LiFePO4 Battery vs. Lithium-Ion LiFePO4 vs NMC Home ESS Lithium Battery Manufacturer Lithium Battery Safety Tips lithium ion battery Market Trends Off-Grid Solar Batteries for European Homes Reliable Home Battery Bulk Suppliers Solar Batteries in Syria Solar Panel solar system Top 10 Home Battery Alibaba Suppliers Verified Wall-Mounted Lithium Batteries Wall vs Rack Batteries

![[Guia 2025]Bateria Solar no Brasil: 72% de Economia + Luz 24h! 🔋 此图片的 alt 属性为空;文件名为 image-31-png.webp](https://coolithium.com/wp-content/uploads/2025/04/image-32.webp)